How to e-File Income Tax Return with Ardh Sainik Group

Employees of the Central Paramilitary Forces work under exceptionally demanding, demanding, harsh, and specific Services working conditions that prevent them from maintaining their account records. As a result, the Ardh Sainik Welfare Trust set up the option for filing income tax returns regularly because they play a crucial role in establishing a person's financial status in society and their ability to meet basic needs.

Ardh Sainik ITR Support is a program that provides assistance to Armed Forces personnel and their families in filing their Income Tax Returns (ITR). The program aims to simplify the tax filing process for the brave men and women serving our country.

The deadline for filing ITRs is usually July 31st of every year. However, military personnel and their families are often posted in remote areas or conflict zones, making it difficult for them to file their ITRs on time. Ardh Sainik ITR support helps these individuals file their ITRs before the deadline, ensuring they do not miss any benefits or incur penalties.

The Eligibility Criteria For Filing ITR:

The basic exemption limit for people for the fiscal year 2023–2024 is Rs. 2.50 lakhs. You qualify to file an ITR if your annual income exceeds this threshold.

Age requirements: Different exemption thresholds apply to anyone under 60, seniors (those between 60 and 80), and super seniors (those above 80).

Residential status: A person's residential status affects the income tax laws that apply to them. A person may be a resident, a non-resident, or someone who is not typically a resident (NOR). Individuals who are residents must pay taxes on their worldwide income.

Business income: Whatever your income level, you must file an ITR if you are self-employed or a business owner.

Capital gains: You must pay capital gains tax if you sell any capital assets during the year, such as stocks or real estate.

Foreign income: If you live in India and have income from a foreign source, you must file an ITR. In India, income derived from foreign sources is subject to tax, and you must include it in your ITR.

TDS deduction: To collect a refund of any excess TDS that was paid, you must file an ITR if you received any income.

Documents Needed for Filing Income Tax Returns: Before filing your income tax return, you must gather all the required paperwork such as:

- Form 16 or salary certificate issued by the employer

- Form 26AS - This document shows the tax deducted at source (TDS).

- Bank statements showing interest earned on savings accounts and fixed deposits.

- Form 16A or TDS certificate for non-salary income like rent, commission, etc.

- Proof of investment in tax-saving instruments like PPF, ELSS, insurance, etc.

- Form 15G/15H (if applicable)

- Aadhaar Card or PAN Card.

For troops, submitting an income tax return can be a difficult undertaking, but with the aid of Ardh Sainik Legal Associates, the procedure can be simple. Soldiers can easily file their income tax returns and adhere to the tax regulations by taking the steps outlined above.

The steps for filing an income tax return for the community of troops are as follows:

Step 1: Gather all required paperwork.

Before filing your income tax return, you must gather all the required paperwork, such as Form 16, Form 26AS, bank and investment statements, rent receipts, etc. you might get assistance from Ardh Sainik Legal Associates in compiling these documents.

Step 2: Sign up on the website of the Income Tax Department.

You must sign up on the Income Tax Department's website if you still need to. You can register by going to the Income Tax Department's e-filing website (http://ardhsainik.in/) and selecting the 'Register Yourself' button. Enter the necessary information, then write.

Step 3: Submit your tax return

You can begin completing your income tax return as soon as you have gathered all the required paperwork and enrolled on the Income Tax Department's (http://ardhsainik.in/) website. In addition, you can get assistance from Ardh Sainik Legal Associates with your tax return filing.

Step 4: Check your income tax return.

You must confirm your income tax return after filing it. You can use any of the following techniques to check your income tax return:

Net banking with Aadhaar OTP

You can get assistance from Ardh Sainik Legal Associates in validating your income tax return by using a bank account, demat account, ATM, or EVC through a bank account.

Step 5: Verify the status of your income tax return.

You can monitor the status of your income tax return after you have verified it. By accessing the Income Tax Department's e-filing website and selecting the 'See Returns/Forms' button, you can find out the status of your income tax return.

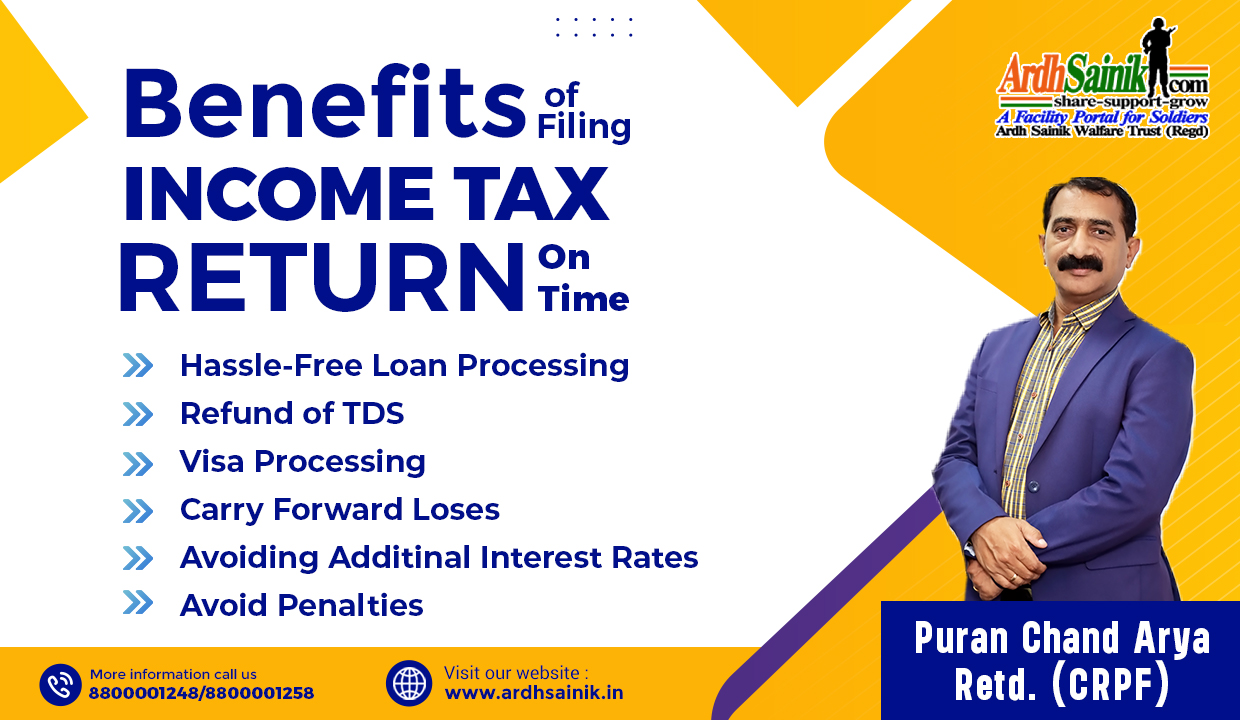

ADVANTAGES OF FILING INCOME TAX RETURN

ITR filing without problems: Filing an ITR can take time and effort for individuals unfamiliar with the process. With their hassle-free ITR filing service, Ardh Sainik ITR Support handles the entire procedure on your behalf. You have to provide them with your financial information, and they'll handle everything else.

Timely Filing: The annual deadline for ITR submission is typically July 31st. But, with Ardh Sainik ITR Support's assistance, you can submit your ITR well before the deadline.

Professional Advice: The tax experts at Ardh Sainik ITR Help can provide professional guidance on tax-related issues. They can advise you on tax-advantageous purchases, deductions, and exemptions to help you reduce your tax liability.

Accuracy: ITR filing calls for precision and close attention to detail. The accuracy and faultlessness of your ITR are ensured by Ardh Sainik ITR Help, reducing the possibility of mistakes and penalties.

Save Time: Submitting an ITR might take time, especially if it's your first time. You can save a lot of time by working with Ardh Sainik ITR Help because they handle the entire process on your behalf.

ITR filing is a vital financial obligation that all residents must do. A hassle-free, timely, accurate, professional, and cost-efficient ITR filing service is provided by Ardh Sainik ITR Help. You may easily file your ITR with their assistance, save time and money, and avoid trouble for filing it late or incorrectly. As a result, using Ardh Sainik ITR Help for your ITR filing requirements is highly advised.

Documents Required to Claim the Following Expenses as Deductions

- Your contribution to Provident Fund

- Your children’s school tuition fees

- Life insurance premium payment

- Stamp duty and registration charges

- Principal repayment on your home loan

- Equity Linked Savings Scheme/Mutual Funds investment

- Home Loan Principal Payment.

- New Pension Scheme (NPS) (Under Sec 80CCD) Atal Pension Yojana.